We have compiled the main points below and highlighted the changes which will be implemented depending on your family situation.

Two-parent family

A married couple in PAYE employment with dependent children will see the following changes to their payslips next year:

1. Changes to USC include an increase of the threshold for payment of USC from €12,012 to €13,000, and to the rates as follows:

1.5% to 1% for income up to €12,012

3.5% to 3% for income between €12,012 - €18,668

7% to 5.5% for income over €18,668

2. Home Carer Tax Credit to be increased by €190 to €1,000 and income threshold increased to €7,200

3. Child Benefit increased by €5 per child per month for all families (€60 per child per year)

4. Tapered employee’s PRSI for low income earners

Examples of Annual Savings

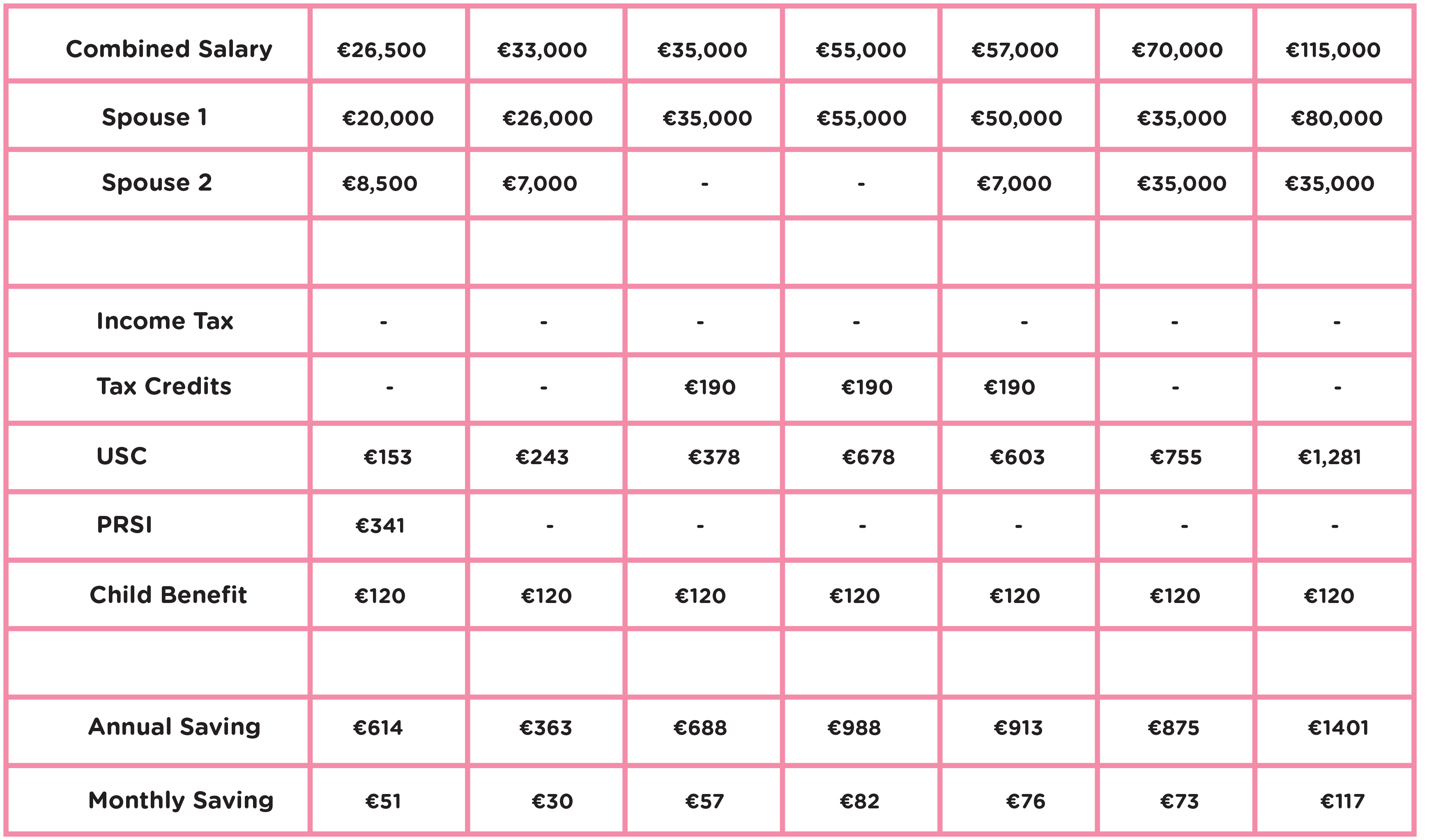

A summary of how these changes affect a married couple with 2 dependent children depending on their salary level is outlined below.

Other benefits for families in the budget

1. Second year free pre-school care for every child aged between three and five

2. Two weeks paid paternity leave

Figures provided by Red Oak Tax Refunds