Permanent TSB instruct mum of three to sell house because of arrears

Filed under:

Money & Finance

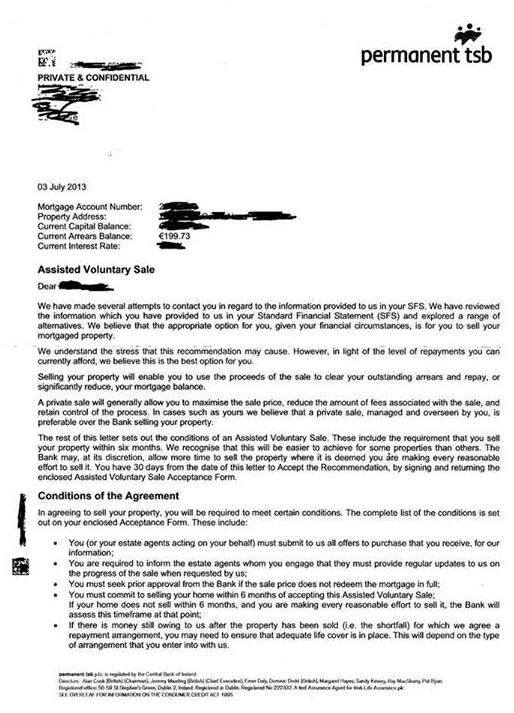

I saw today that a single mum of three, who has been having trouble paying her mortgage has received this letter from the bank telling her she should sell her family home.

As from what I read, she had been on an agreed interest only payment plan with the bank for three years, since her retail business had suffered during the recession. Her case was reassessed by the bank, who upon receipt of her Standard Financial Statement, contacted her and demanded that she pay an additional €300 a month. She was not in a position to pay the extra, but suggested that she might be able to achieve €150 extra. The bank refused, and told her that she 'no longer fit the criteria' as her situation showed no signs of improvement. Just days later, she received the letter telling her to sell up.

She was, understandably, absolutely devasted to receive the letter (and I'm sure was absolutely terrified too). She said that, despite her financial difficutlies in recent yeras, she has always paid her bills, that she doesn't live beyond her means, doesn't go out, doesn't buy clothes or entertain at home.

She has a 20 year mortgage, and has already paid of 10 years. She bought her house for €152,000 and the current value is €150,000. She has now applied to the High Court to have her case reviewed.

It really looks to me that the bank are chasing her just because she has paid off so much, and now they are cutting her loose becuase they know their loan is now totally covered. I think that if the house were in serious negative equity, that she would not be targeted in this way.

The bank's response when queried on this matter was to say:

"There are sound reasons why a proposal like this might be made to a customer who apears to have a low arrears balance”.